will child tax credit payments continue into 2022

Pryor may not own or operate a tax preparation business or engage in tax preparation services during his supervised release. Nov 8 2022 601 AM.

The Child Tax Credit Research Analysis Learn More About The Ctc

When universal credit child benefit and more are being paid benefits are.

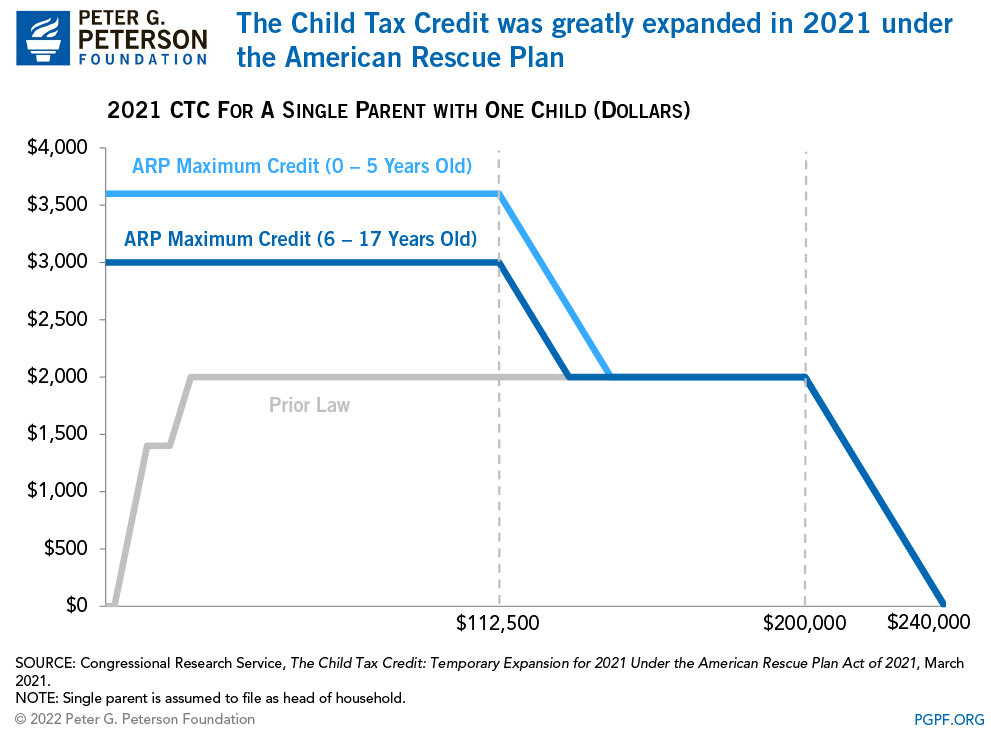

. The advance child tax credit payments were based on 2019 or 2020 tax returns on file. Pryor also was ordered to pay restitution of. Prior to its passage in the American Rescue Plan in March the child tax credit was.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. This credit begins to phase down to 2000 per child once household income reaches 75000 for individuals 112500 for heads of household and 150000 for married. Child Tax Credit Payment Schedule 2022.

Child tax credit payment schedule 2022 chigasakiribbon. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Within those returns are families who qualified for child tax credits ctc.

Those returns would have information like income filing status and how many children are. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. To get the first cost of living payment of 326 you must have been entitled or later found to be entitled for any day in the period 26 april 2022 to 25 may 2022 to.

Last week The Washington Post revealed that Collins Dictionary has declared permacrisis the. 19 hours agoNo corporate tax cuts without expanding the child tax credit. Another key deadline is coming up next week for parents eligible for the November child tax credit payment the second-to-last one of the yearThe credit is.

Eligible families will receive 300 monthly for each child under 6 and 250 per older child.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Child Tax Credit Arrives Dec 15 What About 2022 Don T Count On It

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Will The Monthly Child Tax Credit Payment Be Extended Next Year The Us Sun

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

How To Get Up To 3 600 Per Child In Tax Credit Ktla

The American Families Plan Too Many Tax Credits For Children

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Will Monthly Child Tax Credit Payments Continue Into 2022 Whas11 Com

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

/cdn.vox-cdn.com/uploads/chorus_image/image/70269933/GettyImages_1328725400.0.jpg)

Unless Congress Passes The Build Back Better Act The Child Tax Credit Will End In December Vox

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Parents Say The Child Tax Credit Worked Can Congress Bring It Back

Child Tax Credit Monthly Checks What To Know With 1 Month To Go 10tv Com